Introduction

In the ever-evolving landscape of government fiscal policies, the privatisation of public assets has been a contentious issue for decades. While proponents argue it can lead to increased efficiency and improved services, critics point to a significant downside: the loss of government revenue. This article delves into the vast sums of revenue that have been lost at all levels of government due to the privatisation of public assets.

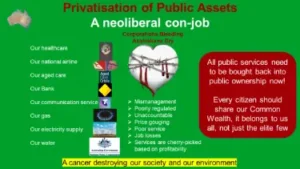

The Privatisation Wave

Privatisation is the process of transferring public/government-owned assets, services, or enterprises into private hands. It gained prominence in the late 20th century as governments looked to reduce their involvement in various sectors, from transportation to utilities and beyond. Proponents argued that privatisation would introduce competition, stimulate innovation, and help the economy.

Ownership and Accountability

It is crucial to understand that the citizens of Australia own “government-owned assets.” These assets are held in trust by the government on behalf of the public. When these assets are privatised, it is a shift of ownership from the collective citizenry to private entities. This transfer raises questions about the stewardship of public resources and the accountability of those who manage these assets for the benefit of the entire population.

Privatisation often involves significant public assets, such as power utilities, transportation networks, and telecommunications infrastructure. These assets, initially funded and supported by public money, are essential for public welfare and economic stability. When sold, the control over pricing, quality, and accessibility shifts to private hands, whose primary motive is profit. This shift can result in higher costs for services and reduced quality, adversely affecting the public that originally funded these assets.

Is Privatisation of Public Assets Theft?

The notion that the sale of public assets could be considered theft is a perspective held by some critics of privatisation. This viewpoint is based on the belief that public assets, originally owned by the citizenry and managed by the government, should remain in public hands. The argument is that when these assets are sold to private entities, it effectively transfers ownership away from the public without their direct consent, which some perceive as a form of theft or misappropriation of public property.

Critics argue that privatisation often occurs without adequate public consultation or transparency. Governments may prioritize short-term financial gains over long-term benefits, selling off assets to address budget deficits or fund new projects. However, this can leave future generations without crucial infrastructure and services that were once publicly available. Moreover, the profits generated from privatised assets flow to private investors rather than being reinvested into the community, worsening economic inequality.

The Revenue Conundrum

Privatisation often comes at a cost—literally. When public assets are privatised, governments lose a significant source of revenue.

Federal Government Losses

The federal government has seen substantial revenue losses due to privatisation. Airports, seaports, and telecommunications spectrum auctions are just a few examples of assets that have been transferred to private entities. These transactions have yielded large upfront payments but have resulted in a long-term revenue shortfall. Over the past few decades, the federal government has lost billions of dollars in potential revenue streams.

For instance, the privatisation of telecommunications has led to a decline in regular revenue that could have been reinvested into national infrastructure projects. The sale of airports and seaports, while providing immediate financial relief, has limited the government’s ability to generate ongoing revenue from these critical transportation hubs. This revenue could have funded public services and reduced the need for higher taxes or borrowing.

State Government Impact

State governments have faced similar challenges. Privatisation of toll roads, public transportation systems, and state-owned utilities has diminished their revenue base. This loss can strain budgets and limit the funds available for vital services such as education and healthcare.

Take the example of toll roads. While selling these assets can bring in immediate funds, the long-term revenue from toll collections, which could have supported state budgets, is lost. Similarly, the privatisation of public transportation can lead to higher fares and reduced services, affecting low-income residents who rely on affordable transportation. State-owned utilities, once a steady source of income, when privatised, often result in higher costs for consumers and less revenue for the state.

Local Government Challenges

At the local level, municipalities have also dabbled in privatisation. From the sale of public parking facilities to the outsourcing of waste management services, cities have lost revenue streams that could have supported essential public services.

Municipalities have sold off parking facilities, leading to higher parking fees and less revenue to fund local services. Outsourcing waste management can result in job losses and reduced service quality, affecting residents’ quality of life. These lost revenue streams mean local governments have less money to invest in community projects, parks, public safety, and other critical services.—

Conclusion

The privatisation of public assets has undeniably led to significant revenue losses for governments at all levels. While proponents of privatisation argue that economic growth can eventually balance the equation, the immediate impact on government budgets and the provision of essential services cannot be ignored. As governments continue to navigate the complex terrain of privatisation, the challenge is to strike a balance between economic benefits and revenue preservation.

Call to Action

What are your thoughts on the privatisation of public assets? Should the government keep control over these resources, or is privatisation the way forward? Share your opinions in the comments below!

Share this article with your contacts and on social media to spread awareness!

Questions for Readers

1. Do you think privatisation helps the economy overall?

2. How has privatisation affected your local community?

3. Should governments find alternative ways to generate revenue instead of selling public assets?

References:

Much has been lost from decades of asset privatisation: https://www.macrobusiness.com.au/2017/04/much-lost-decades-asset-privatisation/

Privatisation in Australia: https://en.wikipedia.org/wiki/Privatisation_in_Australia

How the Labor Party Sold Australia’s Public Assets for a Song: https://jacobin.com/2021/03/australian-labor-party-paul-keating-privatization-neoliberalism

Privatisation is deeply unpopular with voters. Here’s how to end it: https://www.theguardian.com/commentisfree/2018/jan/29/privatisation-is-deeply-unpopular-with-voters-heres-how-to-end-it

The Cost of Market Experiments: https://australiainstitute.org.au/wp-content/uploads/2020/12/P470-Electricty-Consumers-Pay-the-Price-WEB.pdf

The Privatisation of CSL: https://australiainstitute.org.au/wp-content/uploads/2020/12/DP4_8.pdf

Privatisation: https://essentialvision.com.au/privatisation