Description

Labor economic policies. In-depth analysis of Labor’s economic policies. Are they truly helping all Australians? Explore the impact on cost of living, jobs, and more.

Introduction

The Australian Labor Party, currently at the helm of the federal government, has implemented various economic policies to tackle the nation’s pressing challenges. As the government faces fluctuating public support, there is increasing scrutiny over whether Labor economic policies will genuinely help all Australians. This article delves into the key economic strategies of the Labor government, evaluating their effectiveness, challenges, and the broader implications for the Australian economy.

I. Labor Government’s Current Popularity

A. Recent Trends in Labor’s Popularity

Labor’s popularity has experienced a decline in recent months, reflecting growing public dissatisfaction with the government’s handling of economic issues. The rising cost of living and unmet expectations from the electorate have led to significant public debate, with many Australians questioning whether the government’s policies are truly effective.

B. Factors Contributing to the Popularity Slide

Several factors have contributed to this slide in popularity:

1. Cost of Living Crisis: Many Australians are feeling the strain of rising prices for essential goods and services.

2. Unmet Expectations: Voters expected more immediate and tangible relief from economic pressures.

3. Political Opposition: The Liberal Party and other opposition groups have used these issues to erode public confidence further.

C. Comparison with Past Political Scenarios

Labor’s current situation is not unique; similar dips in popularity have occurred in past governments facing economic crises. The challenge lies in balancing effective policy implementation with keeping public support, a delicate task that has historically determined political success or failure.

II. Key Economic Policies of the Labor Government

Labor’s economic policies are intended to address significant issues within the Australian economy. However, their actual effectiveness in achieving these goals is mixed. Here’s a closer look at four key policies and their impact.

A. Tax Reform: Aiming for Fairness and Equity

Overview

Labor’s tax reform agenda looks to increase revenue from high-income earners and large corporations while providing tax relief for low- and middle-income Australians. Measures include raising the marginal tax rate for top earners and closing corporate tax loopholes.

Critique

While these reforms are intended to promote fairness, their effectiveness has been debated. The increased tax revenue has indeed allowed the government to fund critical public services without imposing austerity. However, critics argue that higher taxes on the wealthy could discourage investment, potentially slowing economic growth. Moreover, despite efforts to close loopholes, corporations often find new strategies to minimize their tax burdens.

The tax relief offered to lower and middle-income Australians has not fully mitigated the impact of rising living costs. With inflation and stagnant wages eroding real income, many households find that the benefits of these tax cuts are overshadowed by other economic pressures.

Conclusion

Labor’s tax reforms have made some progress in addressing income inequality, but the broader economic benefits are limited. To achieve more substantial results, the government might need to explore other measures, such as expanding social safety nets and tackling wage stagnation directly.

B. Healthcare Funding: Enhancing Access to Universal Healthcare

Overview

Labor has significantly increased funding for Medicare, with the goal of ensuring all Australians have access to quality healthcare. This funding includes investments in hospitals, mental health services, and bulk-billing incentives to reduce patients’ out-of-pocket expenses.

Critique

Increased healthcare funding is a cornerstone of Labor’s economic policy, directly affecting the well-being of Australians. The added resources for hospitals and mental health services are particularly timely, given the strains placed on the healthcare system during the COVID-19 pandemic.

However, despite these investments, challenges remain. Long wait times in public hospitals, a shortage of healthcare professionals, and unequal access to services in rural and remote areas continue to hinder the effectiveness of increased funding. Moreover, the reliance on bulk-billing incentives has not fully alleviated the burden of rising out-of-pocket costs, which remain a significant barrier for many Australians.

Conclusion

Labor’s healthcare funding boost is a positive step, but systemic issues within the healthcare system still need to be addressed to ensure all Australians benefit. Future reforms should focus on improving service delivery, particularly in underserved regions, and reducing the financial burden on patients.

C. Affordable Housing Initiatives: Addressing the Housing Crisis

Overview

Labor has launched several initiatives to increase the supply of affordable housing and support first-time homebuyers. These initiatives include the construction of new social housing units, grants for first-time buyers, and incentives for developers to build affordable housing.

Labor has launched several initiatives to increase the supply of affordable housing and support first-time homebuyers. These initiatives include the construction of new social housing units, grants for first-time buyers, and incentives for developers to build affordable housing.

Critique

Addressing Australia’s housing crisis is a critical part of Labor’s economic strategy. The construction of new social housing and first-time buyer grants are commendable efforts to increase housing availability. However, the effectiveness of these initiatives in resolving the broader housing crisis has been limited.

The demand-driven nature of these programs has, in some cases, exacerbated competition in the housing market, leading to higher prices in certain areas. Furthermore, the focus on new construction has not sufficiently addressed the core issue of housing affordability, especially in major cities where property prices are still exorbitantly high. The incentives provided to developers, while well-intentioned, have not consistently resulted in the creation of truly affordable housing, as developers often prioritize profit over affordability.

Questioning the Need for Developer Incentives

One significant point of contention is the reliance on private developers to build affordable housing. The government has chosen to offer incentives to these developers to encourage the construction of housing that meets affordability criteria. However, this approach raises several important questions about the role of the government in addressing the housing crisis.

Why is the Government Privatizing This Work?

The reliance on private developers to provide affordable housing is a form of privatization, where the government outsources what could be considered a public responsibility. This approach assumes that the private sector, driven by profit, can deliver public goods more efficiently. However, evidence suggests that this assumption is flawed, particularly in the context of affordable housing.

Privatization has often led to outcomes that prioritize profitability over public interest. In the case of housing, developers are incentivized to maximize their returns, which can conflict with the goal of providing genuinely affordable homes. Even with government incentives, the profit motive often results in housing that is only marginally affordable, if at all. Furthermore, this approach has sometimes led to substandard housing, as developers cut corners to reduce costs.

Government-Led Initiatives Could Be More Cost-Effective

The government has the capacity to directly address the housing crisis through public investment in housing. By taking on the role of both funder and builder, the government could potentially deliver affordable housing more effectively and at a lower cost. Without the need to generate profits, public housing projects could focus solely on meeting the needs of the population, ensuring that homes are truly affordable and built to high standards.

Public housing programs have historically played a crucial role in providing secure, affordable housing to those in need. However, the shift towards privatization and reliance on the private sector has diminished the role of public housing, contributing to the current crisis. By revitalizing public housing initiatives, the government could take a more active role in solving the housing problem, rather than relying on the private sector, which has often failed to meet the demand for affordable housing.

Conclusion

The government’s current strategy of incentivizing private developers to build affordable housing is not without flaws. Given the challenges associated with privatization and the potential for profit-driven motives to undermine public goals, it may be time to reconsider this approach. By taking direct responsibility for the construction of affordable housing, the government could ensure that the needs of the population are met more effectively and equitably. Labor’s housing initiatives, while a step in the right direction, could receive help from a shift towards more government-led solutions, emphasizing the public good over private profit.

D. Education and Skills Training: Boosting Employment and Economic Growth

Overview

Labor has prioritized education and skills training, aiming to equip Australians with the necessary skills to succeed in a rapidly evolving economy. The government has expanded access to education and vocational training, particularly in high-demand sectors like technology, renewable energy, and healthcare.

Critique

Investing in education and skills training is essential for fostering economic growth and reducing unemployment. Labor’s initiatives in this area have successfully expanded access to education, with increased funding for vocational training programs and apprenticeships. These efforts have helped address skills shortages in key industries and provided many Australians with pathways to employment.

Historical Role of Governments in Training

Historically, governments at all levels in Australia played a significant role in training apprentices and other professionals. Public sector institutions and government-run technical and further education (TAFE) colleges were the primary providers of vocational education and training (VET). These institutions offered robust apprenticeship programs and other professional training opportunities, ensuring that a skilled workforce was consistently developed to meet the needs of the economy.

Historically, governments at all levels in Australia played a significant role in training apprentices and other professionals. Public sector institutions and government-run technical and further education (TAFE) colleges were the primary providers of vocational education and training (VET). These institutions offered robust apprenticeship programs and other professional training opportunities, ensuring that a skilled workforce was consistently developed to meet the needs of the economy.

Government-led training initiatives were comprehensive, publicly funded, and focused on delivering high-quality education that aligned with the needs of both the public sector and the broader economy. Apprenticeships were often tied to public infrastructure projects or government services, providing trainees with practical, hands-on experience while contributing to public goods.

Shift to Private Enterprise

In recent decades, however, there has been a significant shift toward relying on private enterprises to train apprentices and other professionals. This move was driven by the broader trend of privatization and the belief that the private sector could deliver training more efficiently. Consequently, many traditional government-led training programs were downsized or dismantled, and the responsibility for vocational training was largely transferred to private companies and private training providers.

This shift has led to a fragmented system where the quality and availability of training can vary widely. Private enterprises often focus on training that directly benefits their immediate business needs, which may not align with broader economic or societal goals. Furthermore, the privatization of training has introduced cost barriers for individuals, making vocational education and apprenticeships less accessible to those who cannot afford to pay for private training programs.

The Argument for Free Education

Another critical issue is the cost of education. The shift toward privatization and the reduction in government-funded training programs have contributed to the growing belief that education, including vocational training, should be provided free of charge. Education is a fundamental right and an essential public good. Providing free education at all levels would ensure that every Australian has the opportunity to gain the skills and knowledge needed to participate fully in the economy and society.

Free education would remove financial barriers, allowing more people to access training and professional development opportunities. It would also ensure that vocational training is aligned with public needs, rather than being driven solely by the profit motives of private enterprises. By making education free, the government would be investing in the future of the nation, creating a more skilled and adaptable workforce capable of meeting the challenges of the modern economy.

Conclusion

Labor’s investment in education and skills training is a crucial step toward building a stronger, more resilient economy. However, the current reliance on private enterprise for training apprentices and other professionals raises concerns about the accessibility and quality of vocational education. Historically, governments were the main providers of such training, ensuring that it was comprehensive and aligned with public needs. A return to more government-led training initiatives, coupled with the provision of free education, would ensure that all Australians have the opportunity to gain the skills necessary for success in the modern economy. By reinvesting in public education and training, the government can help create a more equitable and prosperous society.

Federal Government’s Financial Capacity: A Critical Insight

It’s essential to recognize that the federal government, unlike households or businesses, is not financially constrained in the same way. As a sovereign issuer of its own currency, the Australian government can always fund its spending if there are available resources in the economy—such as labor, materials, and technology. The primary constraint on government spending is not financial but the availability of real resources and the risk of inflation. Therefore, the government can implement and sustain ambitious economic policies, provided they are managed responsibly and aligned with the economy’s productive capacity.

III. Effectiveness of Labor’s Economic Policies

Labor’s economic policies reflect a genuine effort to address the challenges facing Australia, including income inequality, healthcare access, housing affordability, and employment. However, the effectiveness of these policies in delivering widespread benefits has been mixed. The tax reforms have made strides in addressing income inequality, but they have not significantly mitigated the cost-of-living crisis. Healthcare funding has enhanced access to services, but systemic issues persist. Housing initiatives have increased supply but have not resolved affordability issues. Education and skills training have expanded opportunities but concerns about accessibility and alignment with industry needs remain.

IV. Public Perception and Reaction

Public perception of Labor’s economic policies is mixed. Some Australians appreciate the government’s efforts to address inequality and invest in public services, while others feel the benefits have not been evenly distributed. The disparity between urban and rural areas in terms of policy impact is also notable, with rural Australians often feeling left behind.

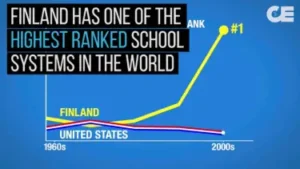

V. Comparative Analysis

Labor’s policies, compared to earlier governments, reflect a shift toward greater public spending and social welfare. However, their effectiveness is still uncertain, especially when compared to international examples where similar policies have been implemented with varying degrees of success.

VI. Challenges and Criticisms

Labor’s economic policies have faced criticism from various quarters. While the government’s ambitions are clear, the challenges in implementation, potential unintended consequences, and public dissatisfaction highlight areas where improvement is needed.

VII. Potential Future Scenarios

Looking ahead, Labor’s political future may depend on its ability to adapt its policies in response to public feedback and economic realities. The upcoming elections will be crucial in deciding whether the government can maintain its course or will need to make significant adjustments.

VIII. Conclusion

Labor economic policies. Labor’s economic policies have had a mixed impact. While the government has made significant investments in public services and infrastructure, the benefits have not been evenly distributed across the population. The government must address the root causes of economic inequality and ensure that its policies are both effective and fair. By refining its approach and focusing on long-term solutions, Labor can work toward restoring public confidence and ensuring that its economic strategies truly help all Australians.

IX. Call to Action for Readers

– Engage in discussions on economic policies: Share your thoughts and concerns in the comments section.

– Vote based on informed choices: Stay updated on policy changes and their impact on your community.

– Share this article on social media: Help spread awareness by sharing this article with your network.