Description: Federal Government Deficit and Surplus

Learn how Australia’s monetary sovereignty can shape a more ethical political system through effective deficit and surplus management.

Introduction

Australia’s federal politicians often liken the national economy to a household budget, perpetuating myths about deficits and surpluses. This comparison misleads the public about how a sovereign government functions. Unlike a household, Australia’s government, as the issuer of its own currency, operates under different financial principles. This article explores the truths behind federal budget dynamics, debunking myths, and emphasizing the importance of Modern Monetary Theory (MMT) for Australia’s future.

Debunking Household Budget Myths

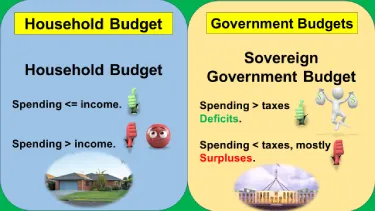

The Fallacy of Comparing National Economy to Household Budgets

Many politicians simplify the economy by comparing it to a household budget. This analogy misrepresents how a sovereign government functions. Households must balance their income and expenses, but a sovereign government that issues its own currency does not face the same constraints. This misconception limits public understanding of government spending and economic policy.

Real Differences Between Household and Government Budgets

– Household Budget: Limited by income, must borrow or cut spending to manage finances.

– Government Budget: Can issue currency, only constrained by inflation.

The household analogy does not account for the government’s ability to create money and manage the economy differently.

Misconceptions About Sovereign Currency Issuance

Australia’s Sovereign Currency Power

Australia’s government, as a sovereign currency issuer, creates the money used in the economy. Unlike households or businesses, it doesn’t rely on tax revenue or borrowing to fund its spending. The primary limit on its spending is inflation, not a lack of funds.

– Sovereign Currency: The government can issue its own money.

– Inflation Constraint: The only real limit to government spending.

Understanding these principles is crucial for grasping why the government doesn’t need taxes to spend.

Taxation’s True Purpose

Why the Government Doesn’t Need Your Taxes to Spend

Taxes are often seen as the primary source of government revenue, but for a sovereign government, this isn’t true. Instead, taxes serve to:

Taxes are often seen as the primary source of government revenue, but for a sovereign government, this isn’t true. Instead, taxes serve to:

– Regulate Inflation: By reducing the amount of money in circulation.

– Redistribute Wealth: Ensuring a fairer society.

– Influence Behaviour: Through incentives or penalties (e.g., carbon taxes, taxes on cigerates and alcohol).

Understanding these roles helps demystify the real purpose of taxation in a sovereign economy.

The Infinite Spending Capacity of Sovereign Governments

Unlimited Government Spending: Reality and Risks

A sovereign government can technically spend unlimited amounts of money. However, the challenge lies in balancing this spending to avoid inflation. When government spending plus private sector spending exceeds the economy’s capacity to produce goods and services, inflation occurs.

– Unlimited Spending: The government can create as much money as needed.

– Inflation Risk: Spending must be managed to avoid inflation.

The focus should be on the economy’s capacity rather than the government’s budget.

Deficits and Surpluses Explained

What Deficits and Surpluses Really Mean

A federal government deficit occurs when government spending exceeds its revenue. Contrary to wildly held belief, this isn’t inherently bad. In fact, a deficit can show a public sector surplus, helping the economy by:

– Stimulating Growth: Through increased spending on infrastructure, healthcare, and education.

– Supporting Welfare: Enhancing social services and job creation.

Conversely, a government surplus means the government is extracting more money from the economy than it is putting in, often leading to austerity measures.

– Deficit: More government spending than revenue, can boost the economy.

– Surplus: Less government spending than revenue, often leads to austerity.

Understanding these concepts clarifies how government spending affects the economy.

The Impact of Government Spending

Benefits of Deficit Spending

Deficit spending can drive economic growth by funding critical public services and infrastructure projects. Examples include:

– Infrastructure Projects: Roads, bridges, and public transport.

– Healthcare and Education: Improved services lead to a healthier, more educated workforce.

– Job Creation: Government projects can create employment opportunities.

These investments can have long-term benefits for the economy and society.

Advocating for Modern Monetary Theory (MMT)

The Future of Australia’s Economy with MMT

Modern Monetary Theory (MMT) offers a framework that aligns with Australia’s status as a sovereign currency issuer. MMT suggests that:

– Government Can Spend Freely: Within the limits of inflation.

– Focus on Real Resources: Rather than financial constraints.

– Public Welfare Priority: Using spending to improve societal well-being.

Adopting MMT principles can help create a fairer and prosperous economy.

Good vs. Bad Deficit Spending

Good Deficit Spending: Benefits for All Citizens

1. Investing in Public Infrastructure:

Roads, bridges, public transport.

Long-term economic growth and job creation.

2. Enhancing Healthcare and Education:

Better healthcare facilities and services.

Improved educational institutions and access.

Healthier, more educated population.

3. Social Welfare Programs:

Support for the unemployed and vulnerable.

Reduction in poverty and inequality.

Formula:

Good Deficit Spending = Infrastructure + Healthcare + Education + Social Welfare

Bad Deficit Spending: Benefits for the Few

1. Corporate Subsidies:

Benefits large corporations at the expense of public welfare.

2. Military Expenditures:

Excessive spending on defense, neglecting public needs.

3. Tax Cuts for the Wealthy:

Increases inequality, benefits a small segment of the population.

Formula:

Bad Deficit Spending = Corporate Subsidies + Military Expenditures + Tax Cuts for the Wealthy.

Why the Australian Government Prioritizes Bad Deficit Spending

Influence of Corporate Interests

1. Lobbying Power:

– Large corporations often have significant lobbying power.

– They influence policymakers to allocate funds in ways that benefit their interests.

2. Political Donations:

– Corporations and wealthy individuals often make substantial political donations.

– This can lead to policies that favor their interests over the public good.

Short-Term Political Gains

1. Visible Results:

– Corporate subsidies and tax cuts can produce immediate economic boosts.

– These visible results are attractive to politicians seeking re-election.

2. Defense Spending:

– High defense budgets can be politically advantageous.

– It allows politicians to appear strong on national security.

Ideological Beliefs

1. Neoliberal Economics:

– Belief in minimal government intervention and free markets.

– Emphasis on reducing public spending and promoting private sector growth.

2. Austerity Measures:

– Focus on reducing deficits through spending cuts and tax increases.

– Often results in underfunding of essential public services.

Consequences of Bad Deficit Spending

1. Increased Inequality:

– Benefits are concentrated among the wealthy and large corporations.

– Widening gap between rich and poor.

2. Neglect of Public Services:

– Underfunded healthcare, education, and infrastructure.

– Reduced quality of life for the general population.

3. Economic Instability:

– Short-term gains can lead to long-term economic issues.

– Lack of investment in essential services can hinder sustainable growth.

Summary

Understanding the dynamics of Australia’s federal government deficit and surplus is crucial for informed public discourse. Debunking myths about household budget comparisons, recognizing the true role of taxation, and appreciating the government’s capacity to manage inflation are key. Embracing Modern Monetary Theory can guide Australia towards a more compassionate and effective economic system.

Question for Readers

How do you think adopting Modern Monetary Theory could change Australia’s future?

Call to Action

To learn more about how economic policies affect your life and future, subscribe to our newsletter, and join the conversation on our website.

Social Sharing

If you found this article insightful, please share it with your contacts and on social media.

References

Federal Government Deficit and Surplus: https://youtu.be/VRT3cyDiRLQ

Modern Monetary Theory and sovereign currency principles: https://www.fraserinstitute.org/sites/default/files/primer-on-modern-monetary-theory.pdf