Description

Cost of living squeeze. Discover how Australians manage rising prices of groceries, energy, and healthcare amidst inflation. Learn coping strategies and solutions.

Introduction

Overview of the Cost-of-Living Crisis

Australia is experiencing a significant cost of living crisis, with inflation reaching levels not seen in decades. This economic pressure has placed a substantial burden on households across the country, making it increasingly difficult for families to afford essential goods and services. From groceries and energy bills to healthcare, the rising costs are squeezing budgets and causing widespread anxiety. This article delves into how Australians are coping with these challenges and offers practical strategies for navigating this tough economic landscape.

The Reality of Rising Prices

Inflation and Its Impact

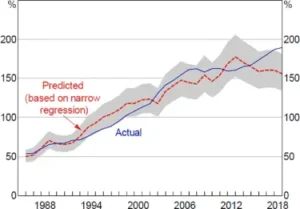

Inflation is a critical factor driving the cost-of-living crisis in Australia. Defined as the general increase in prices and the fall in the purchasing value of money, inflation has surged due to a range of factors, including global supply chain disruptions, labor shortages, and geopolitical tensions. In the first quarter of 2024, inflation in Australia reached 7.8%, significantly eroding the purchasing power of households.

This sharp rise in inflation has had a direct impact on essential goods and services, making everyday necessities more expensive. The Consumer Price Index (CPI), which measures the average change over time in the prices paid by consumers for goods and services, reflects these increases. As inflation continues to rise, households are forced to make difficult choices about how to allocate their limited resources.

The Cost of Essential Goods and Services

Groceries

The cost of groceries in Australia has skyrocketed, with staple foods and everyday items seeing significant price increases. Supply chain disruptions, increased production costs, and labor shortages have all contributed to this trend. For example, the price of a loaf of bread has risen by 15% in the past year, while the cost of fresh produce has increased by as much as 20%.

These price hikes are putting a strain on household budgets, forcing families to cut back on their grocery spending or switch to cheaper alternatives. The rise in grocery costs is particularly challenging for low-income households, who may already be struggling to afford necessities.

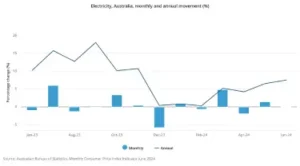

Energy

Energy prices in Australia have also surged, with electricity and gas bills becoming a significant burden for many families. The transition to renewable energy sources, combined with global energy market volatility, has led to higher costs for consumers. A typical Australian household now spends 20% more on energy than they did two years ago.

These rising energy costs have a ripple effect on household budgets, as families are forced to allocate more money to pay for their utilities. For some, this means cutting back on other essential expenses, such as groceries or healthcare, to keep the lights on.

Healthcare

Rising healthcare costs are another significant concern for Australian households. Out-of-pocket expenses for GP visits, prescription medications, and health insurance premiums have all increased, making it more difficult for families to access the care they need. For example, the average cost of a GP visit has risen by 10% in the past year, while health insurance premiums have increased by 5%.

These rising costs are particularly challenging for those with chronic health conditions, who may need regular medical care and medications. As healthcare becomes more expensive, some families are forced to choose between paying for medical care and covering other essential expenses.

Coping Mechanisms Adopted by Australian Households

Budget Adjustments

In response to rising costs, many Australian households are making significant adjustments to their budgets. Families are cutting back on non-essential spending, prioritizing needs over wants, and seeking out cheaper alternatives. For example, there has been an increase in the use of discount grocery stores and generic brands, as households look for ways to stretch their budgets.

These budget adjustments are essential for managing rising costs, but they can also be challenging. Cutting back on non-essential spending often means sacrificing leisure activities, entertainment, and other aspects of quality of life. However, for many families, these sacrifices are necessary to make ends meet.

Increased Reliance on Credit

As living costs continue to outpace wage growth, more Australians are turning to credit cards and personal loans to cover their expenses. This reliance on credit can provide short-term relief, but it also has long-term implications, including increased debt and financial instability. Household debt levels in Australia have risen by 10% in the past year, reflecting the growing financial strain on families.

While credit can be a useful tool for managing cash flow, it also comes with risks. High-interest rates on credit cards and loans can quickly lead to mounting debt, making it even more difficult for families to stay afloat financially. It’s essential for households to be mindful of their borrowing and seek financial advice if needed.

Seeking Government Assistance

Government help programs have become a lifeline for many Australians during the cost-of-living crisis. Programs like the Jobseeker payment, Energy Assistance Payments, and Medicare provide vital support to low-income families and those facing financial hardship. However, accessing these services can be challenging due to bureaucratic hurdles and eligibility requirements.

While government help provides much-needed relief, it’s not always enough to cover the rising costs of living. Many households still find themselves struggling to make ends meet, even with the help of these programs. This highlights the need for ongoing support and potential reforms to ensure that help reaches those who need it most.

Changes in Lifestyle and Consumption Habits

To cope with rising costs, many Australians are making significant changes to their lifestyles and consumption habits. Some families are downsizing their homes to reduce housing costs, while others are cutting back on energy usage to lower their utility bills. There has also been a shift towards more frugal living, with families adopting practices such as meal planning, bulk buying, and reducing waste.

These lifestyle changes can help families manage their expenses, but they also require a significant adjustment. For example, moving to a smaller home may mean sacrificing space and comfort, while cutting back on energy usage may require changes in daily routines. Despite these challenges, many families are finding that these changes are necessary to stay financially afloat.

The Social and Psychological Impact

Stress and Mental Health

The financial stress caused by rising costs and underemployment has far-reaching effects on mental health and well-being. When households struggle to meet their financial obligations, it can lead to anxiety, depression, and other stress-related illnesses. A 2023 survey by the Australian Psychological Society found that 72% of respondents reported feeling stressed about their financial situation, with many saying that this stress was affecting their overall health.

Financial stress doesn’t just affect mental health; it can also affect work performance and productivity. Employees facing financial difficulties may experience reduced concentration, higher absenteeism, and lower job satisfaction. This creates a cycle of stress and financial instability, as poor work performance can lead to job insecurity and further financial strain.

Mental health support services are crucial for helping individuals cope with the psychological impact of financial stress. Organizations like Beyond Blue and Lifeline Australia offer resources and counselling to those struggling with anxiety and depression related to financial hardship. However, the demand for these services has surged, highlighting the need for increased funding and accessibility.

Family Dynamics and Relationships

Financial pressures can strain relationships and disrupt family dynamics. Couples may argue more often about money, leading to tension and, in some cases, separation or divorce. According to Relationships Australia, financial stress is a significant contributor to relationship breakdowns, with 60% of couples citing money as the primary source of conflict.

Children in financially stressed households are also affected by the pressures of rising costs. They may see arguments about money, feel the impact of reduced household spending, and experience anxiety about their family’s financial stability. Research from the Australian Institute of Family Studies shows that children in financially stressed households are more likely to experience emotional and behavioural issues.

To mitigate the impact of financial stress on family dynamics, open communication and joint financial planning are essential. Families are encouraged to discuss their financial situation openly, set realistic budgets, and work together to make necessary lifestyle adjustments. Support from community organizations and financial counsellors can also help families navigate these challenging times.

Policy Responses and Economic Outlook

Government Initiatives

The Australian government has implemented several measures to address the cost-of-living crisis, including monetary policy adjustments and direct financial aid. The Reserve Bank of Australia (RBA) has been actively managing interest rates to control inflation, aiming to cool the economy and reduce inflationary pressures. However, these interest rate hikes have also increased mortgage payments for homeowners, adding to the financial burden on households.

In addition to monetary policy, the government has introduced direct financial aid programs to support low-income families and those facing financial hardship. These include increased payments for welfare recipients, such as the Jobseeker and Youth Allowance, and one-off cost-of-living payments for pensioners and low-income earners. The government has also expanded eligibility for energy rebates and healthcare concessions to help those most affected by rising costs.

Despite these measures, there is ongoing debate about the need for long-term policy solutions to address the root causes of the cost-of-living crisis. Proposals include increasing the minimum wage, expanding social housing to reduce rental pressures, and investing in renewable energy to lower long-term energy costs. These policies aim to create a more resilient and fair economy that can better withstand future shocks.

Expert Opinions

Economists and financial experts offer varying perspectives on the future trajectory of inflation and its impact on the cost of living in Australia. Some experts, like those from the Grattan Institute, predict that inflationary pressures will gradually ease as global supply chains stabilize, and energy prices decline. However, they caution that this process may take time, and households should prepare for continued financial pressure in the short term.

Global factors also play a significant role in Australia’s economic outlook. The ongoing conflict in Ukraine has disrupted global energy markets, leading to higher energy prices worldwide. Trade tensions between major economies, such as the US and China, further contribute to economic uncertainty. These factors make it difficult to predict the exact path of inflation, but they underscore the need for households and policymakers to still be vigilant and adaptable.

Financial experts recommend that households focus on building financial resilience by reducing debt, increasing savings, and seeking professional financial advice. They also emphasize the importance of government intervention to address structural issues in the economy, such as wage stagnation and housing affordability, which contribute to the cost-of-living crisis.

Conclusion

Summary of Key Points

The cost-of-living crisis in Australia presents significant challenges for households across the country. Rising inflation, driven by global economic factors and domestic pressures, has led to sharp increases in the cost of essential goods and services, including groceries, energy, and healthcare. As a result, many Australians are struggling to make ends meet, leading to increased financial stress and mental health issues.

In response to cost of living squeese, households are adopting various coping mechanisms, such as adjusting their budgets, relying more on credit, seeking government aid, and making lifestyle changes. While these strategies provide some relief, they also highlight the need for long-term solutions to address the root causes of the cost-of-living crisis.

Call to Action

To navigate this challenging economic landscape, it is essential for Australians to stay informed about economic trends and government policies that affect their financial well-being. By understanding the broader economic context, individuals can make more informed decisions about their finances and advocate for policies that address the cost-of-living crisis.

Readers are encouraged to engage with their local representatives and support measures that increase wages, improve access to affordable housing, and reduce the cost of essential services. Additionally, seeking professional financial advice can help households develop strategies to manage their finances and build resilience against future economic shocks.

Finally, consider ways to support others in your community who may be struggling. Whether through volunteering, donating to food banks, or simply offering a listening ear, collective action can help alleviate the pressures many Australians are facing.

Data and Charts

– Inflation Trends: A graph showing the rise in the Consumer Price Index (CPI) over the past 12 months, highlighting the periods of the most significant increases.

– Energy Prices: A chart comparing average electricity and gas prices across different states in Australia, illustrating regional variations and the overall upward trend.

– Household Debt Levels: A visual representation of the increase in household debt levels over the past year, correlating with rising costs and financial pressures.

Resources for Further Reading

– Government Reports: https://melbourneinstitute.unimelb.edu.au/publications/macroeconomic-reports

– Academic research: https://psychology.org.au/for-members/publications/inpsych/2023/spring-2023/unravelling-the-psychological-impact

– Financial Guides: https://www.afsa.gov.au/i-cant-pay-my-debts/support-services/where-find-help-managing-debts

Final Thoughts

This comprehensive article provides a thorough exploration of the cost-of-living crisis in Australia, offering valuable insights into the challenges faced by households and the strategies they are employing to cope with rising prices. By addressing the social, psychological, and economic aspects of this issue, the article ensures that readers gain a deep understanding of the topic and are equipped with practical solutions.

Question for Readers

How have rising costs affected your household, and what strategies have you found most effective in managing your budget?

Call to Action

If you found this article helpful, please share it with your friends and family on social media. Don’t forget to subscribe to our newsletter for more tips on managing your finances during tough economic times.