Description

Discover how Australias toll roads exploit motorists through failed privatisation and flawed PPPs, burdening the public.

Introduction

Privatisation was once hailed as the solution to Australia’s infrastructure challenges, promising efficiency, and cost savings. Yet, as Australia’s toll roads increasingly burden motorists, the cracks in this approach are becoming glaringly clear. Public-Private Partnerships (PPPs) were introduced to involve the private sector in infrastructure development, with the idea that both parties would benefit. But instead of creating fair solutions, these partnerships often result in public costs and private gains. This article explores the failures of privatisation in Australia, focusing on toll roads and PPPs, and discusses how these systems profit corporations at the expense of the public.

The Failure of Privatisation in Australia’s Toll Roads

1. Historical Context of Privatisation in Australia

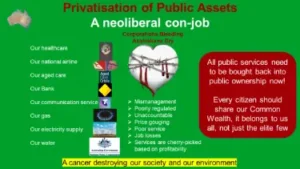

Privatisation in Australia began in the 1980s, driven by neoliberal policies that promoted reduced government spending and increased private sector involvement. The rationale was simple: the private sector, driven by profit, would be more efficient than the government in managing and developing infrastructure. Key public assets, including telecommunications, utilities, and transport infrastructure, were sold to private entities.

Privatisation in Australia began in the 1980s, driven by neoliberal policies that promoted reduced government spending and increased private sector involvement. The rationale was simple: the private sector, driven by profit, would be more efficient than the government in managing and developing infrastructure. Key public assets, including telecommunications, utilities, and transport infrastructure, were sold to private entities.

The toll roads were a significant part of this privatisation wave. Governments, needing to address growing traffic demands and lacking funds for large-scale infrastructure projects, turned to private companies to build and manage toll roads. In return, these companies were allowed to charge motorists for road use, to recoup construction and maintenance costs.

2. The Toll Road Networks: A Case Study in Corporate Profiteering

2.1 Overview of Australia’s Toll Road Networks

Today, Australia’s major cities are encircled by a web of toll roads. These roads, owned and run by private corporations, are essential for many commuters. Companies like Transurban have become household names, controlling vast networks of toll roads across the country. While the development of these roads has undeniably eased congestion in some areas, the cost to the public has been steep.

2.2 The Profits of Privatisation

Toll road operators have reported significant profits, driven by steadily increasing toll fees. For instance, Transurban, the dominant player in this space, regularly reports billion-dollar revenues, much of which comes directly from the pockets of Australian motorists. The business model is straightforward: once the initial construction costs are recovered, toll fees should, in theory, decrease or be removed. However, in practice, tolls often continue indefinitely, with fees increasing periodically. This leads to an ongoing financial burden for motorists, many of whom have no alternative routes available.

2.3 The Lack of Accountability

Privatisation has led to a significant reduction in public oversight. Unlike publicly managed roads, where accountability lies with elected officials, private toll roads are governed by corporate boards focused on maximizing shareholder returns. Transparency is limited, with the terms of agreements between governments and private operators often kept confidential. This lack of accountability has resulted in a system where the public has little say in how these roads are managed or how tolls are set.

The Social and Economic Impact on Motorists

3. The Broken Promises of Privatisation**

Privatisation promised efficiency and cost savings for the public. However, in the context of toll roads, these promises have not been fulfilled. Instead of reducing costs for users, privatisation has led to higher tolls, with fees that can exceed $20 per day for regular commuters. The idea that privatisation would reduce the burden on taxpayers has also proven false, as the public bears the costs of these tolls, often in perpetuity.

3.1 Social Impact on Motorists**

The financial burden placed on motorists by these tolls is significant, particularly for low-income individuals who rely on these roads for daily commuting. For many, toll fees are a substantial part of their monthly expenses, leading to financial stress. The tolls disproportionately affect those living in outer suburbs, who typically have fewer public transport options and are more reliant on private vehicles. The economic inequality created by this system is profound, as those least able to afford tolls are often the most dependent on toll roads.

3.2 Infrastructure Deterioration**

In theory, tolls should be used to support and improve road infrastructure. However, under privatisation, the focus has often been on profit rather than public benefit. This has led to situations where road maintenance is neglected, or other infrastructure projects are delayed keeping costs down. The result is deteriorating infrastructure that does not meet the needs of the public, despite the high tolls collected.

Alternatives to the Current System

4. Tolls as a Public Finance Mechanism: An Alternative Approach

4.1 Government Use of Tolls for Cost Recovery

An alternative approach to privatisation is using tolls as a temporary public finance mechanism. Under this model, the government charges tolls to recoup the initial construction costs of a road. Once these costs are covered, the tolls are removed, and the road becomes free to use. This model ensures that the public benefits from the infrastructure without being burdened by indefinite tolls.

4.2 Benefits of Time-Limited Tolls

Time-limited tolls can be a fairer system for the public. They ensure that motorists are not indefinitely burdened with fees long after the construction costs have been recouped. Additionally, this approach can build public trust, as it shows that the government is committed to managing public assets in the interest of the people, not private corporations.

4.3 Case Studies of Successful Models

Countries like Germany and the Netherlands have successfully implemented time-limited tolls. In these cases, tolls were used to fund the first construction of major roads and highways. Once the costs were recovered, the tolls were removed, and the roads became part of the public infrastructure, supported through general taxation. These models provide valuable lessons for Australia, where similar approaches could alleviate the financial burden on motorists.

4.4 Risks and Challenges

While time-limited tolls offer a promising alternative, they come with challenges. Private corporations with vested interests may resist such changes, particularly if they stand to lose long-term revenue. Additionally, implementing such a system requires strong government commitment and transparency, ensuring that tolls are indeed removed once costs are covered.

5. Private Public Partnerships (PPPs): A Flawed Model

5.1 Understanding PPPs

Private Public Partnerships (PPPs) were introduced to involve the private sector in public infrastructure projects. The idea was that by sharing risks and costs, both the public and private sectors would benefit. However, in practice, PPPs have often resulted in private profits and public losses.

5.2 PPPs in Australia’s Toll Road Networks

In Australia, PPPs have been widely used in the development of toll roads. Governments enter long-term contracts with private companies, allowing them to build and operate roads in exchange for toll revenue. These contracts are often structured to help private companies, with clauses that protect them from financial losses while the public bears the risk.

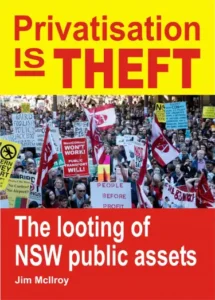

5.3 The Socialisation of Losses

One of the most significant issues with PPPs is the socialisation of losses. When these projects fail or do not generate the expected revenue, it is often the public that is left to cover the costs. This can take the form of government bailouts, increased taxes, or continued tolls long after the initial costs should have been recovered. The public ends up paying twice: once through tolls and again through taxes.

5.4 The Privatisation of Profits

While the public bears the risks, the profits are privatised. Private companies involved in PPPs often secure guaranteed returns through contracts that protect them from losses. This means that even if a toll road underperforms, the private operator still makes a profit, while the public bears the cost of any shortfall.

The Broader Impact on Australia’s Economy and Society

6. Economic Inequality

The privatisation of toll roads and the use of PPPs have worsened economic inequality in Australia. Those who can least afford to pay tolls are often the ones most reliant on toll roads, leading to a regressive system where the poor pay more. This deepens economic disparities and limits social mobility.

6.1 The Erosion of Public Trust

The ongoing burden of tolls and the perceived unfairness of privatisation have eroded public trust in government. Many Australians feel that their interests have been sacrificed for corporate profits, leading to growing disillusionment with the political system. Restoring public trust requires significant policy changes and a commitment to prioritising the public good over private interests.

6.2 Environmental and Social Consequences

Privatised toll roads also have environmental and social consequences. The focus on profit can lead to decisions that prioritise traffic flow and toll revenue over environmental sustainability. Additionally, high tolls can reduce social mobility, as people are less able to travel for work, education, or leisure, leading to increased social isolation and reduced economic opportunities.

Alternatives to Privatisation and PPPs

7. Reconsidering Public Ownership

Re-nationalising essential infrastructure is a practical alternative to privatisation. Public ownership ensures that infrastructure is managed in the public interest, with profits reinvested into the community rather than distributed to shareholders. This approach can also lead to fairer access to services, as decisions are made based on public need rather than profit.

7.1 Successful Models of Public Management

Several countries have successfully managed their infrastructure under public ownership. For example, Norway’s state-owned road and transport networks are among the best in the world, with high levels of public satisfaction. These models show that public ownership can lead to efficient, well-maintained infrastructure that serves the public good.

7.2 Policy Recommendations

To reverse the trend of privatisation, Australia needs comprehensive policy changes. These should include re-nationalising key infrastructure, implementing time-limited tolls, and ensuring that any future PPPs are structured to help the public rather than private corporations. Transparency and public involvement in decision-making are also crucial to restoring trust and ensuring that infrastructure serves the public interest.

Conclusion

8. Summary of Key Findings

Privatisation and PPPs have failed to deliver the promised benefits to the Australian public. Instead, they have led to higher costs, reduced accountability, and increased economic inequality. Toll road networks have become a symbol of this failure, with private companies profiting at the expense of motorists.

8.1 The Path Forward

Australia needs to reconsider its approach to infrastructure management. By embracing public ownership and time-limited tolls, the country can ensure that infrastructure serves the public good rather than corporate interests. These changes are essential for restoring public trust and creating a fairer, more sustainable future.

8.2 Final Thoughts

The failure of privatisation in Australia’s toll roads is a cautionary tale. It highlights the dangers of prioritising profit over public interest and the importance of government accountability. By learning from these mistakes and implementing alternative approaches, Australia can build a fairer and sustainable infrastructure system.

Reader Interaction

What are your thoughts on the impact of privatisation on Australia’s toll roads? Do you think public ownership is the solution? Share your opinions in the comments below.

Call to Action

If you found this article informative, please share it on social media and help spread the word about the need for change in Australia’s infrastructure management.

References

Australia’s Toll Road Debacle.. We’ve Had Enough!: https://youtu.be/Z7I6S-tcj9o?si=rX0rJkCmxq4SWwiQ

Sydney’s Toll Road Mess: An Analysis: https://youtu.be/YB0c4y75iwo

You gotta pay the troll toll to get in!: https://youtu.be/L_1V86vG3IY