Introduction: Unpacking Australias Neoliberal Economy

In recent decades, Australia has embraced neoliberal economic principles, leading to significant changes in its social and economic landscape. This shift has increasingly favoured wealth accumulation for corporations and the wealthy elite, while most Australians face stagnant wages and rising costs of living. This article critically examines the profound influence of corporate interests on policymaking, the role of the Reserve Bank of Australia in exacerbating wealth disparities, and the inequities of the taxation system that contribute to a widening gap between the rich and the poor.

Corporate Interests: A Dominant Force

The Power of Corporate Lobbying

Corporate lobbying in Australia has become a powerful tool for shaping economic and fiscal policies to the advantage of big businesses. Corporations spend millions on lobbying efforts to influence politicians and regulatory frameworks. These investments often yield substantial returns through tailored policies such as reduced regulatory burdens, favourable trade agreements, and direct subsidies that bolster corporate profits at the public’s expense.

Impact on Legislation and Public Policy

The consequence of this corporate sway is a series of legislation that disproportionately favours the wealthy. For example, mining and banking sectors have successfully lobbied for tax concessions and regulatory rollbacks, securing their interests while leaving the broader economy vulnerable to environmental and financial instability. This systemic bias erodes public trust in government and hampers fair economic practices.

The Reserve Bank of Australia: Serving Whom?

Role in Monetary Policy and Economic Disparity

The Reserve Bank of Australia (RBA) is tasked with keeping monetary stability and full employment. However, its approach, particularly the policy of keeping inflation low through high-interest rates, tends to favour capital holders over wage earners. This policy has often been at the expense of broader economic growth and has particularly impacted young Australians and first-time homebuyers, who find themselves priced out of the housing market.

Consequences for Housing Affordability and Wealth Gap

As the RBA focuses on inflation, the real estate prices in metropolitan areas have skyrocketed, creating a significant barrier to entry for new homeowners and contributing to a generational wealth gap. Those who own property see their wealth increase, while those who don’t, face rising rents and the prospect of never owning a home. This division is creating a polarized society where the economic well-being is heavily dependent on property ownership.

Taxation System: Widening the Divide

Analysis of Tax Burdens and Inequities

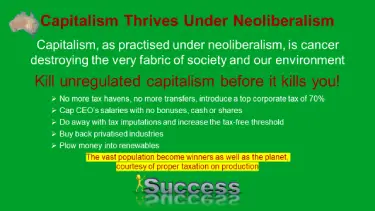

Australia’s taxation system, while progressive on paper, is riddled with inefficiencies and loopholes that allow the wealthy to minimize their tax liabilities significantly. The use of offshore tax havens, trust structures, and capital gains tax discounts has enabled the richest Australians to reduce their tax rates to lower than those faced by the average worker. This not only undermines the fairness of the tax system but also places a disproportionate burden on middle- and lower-income earners.

Need for Tax Reform

While it is often assumed that taxes are necessary to fund government spending, in a sovereign currency system like Australia’s, the government does not require tax revenue to pay for its expenditures. Instead, taxes serve several critical functions in managing the economy, promoting fairness, and addressing inequality. Comprehensive tax reform is still essential, not to fund government operations, but to achieve economic and social goals that ensure fair wealth distribution and resource allocation.

One of the primary purposes of taxes is to reduce inequality by redistributing wealth and moderating excessive concentrations of income and assets. Closing tax loopholes that enable corporations and wealthy individuals to minimize or avoid taxes is crucial for ensuring fairness. Practices such as profit-shifting, trust manipulation, and offshore tax havens undermine equity and allow those with the most resources to contribute the least. Reforming these practices promotes a tax system that better aligns with social values of equity and fairness.

A progressive tax on large inheritances is another essential measure. Although the government does not rely on inheritance taxes for funding, taxing large estates can help prevent the excessive accumulation of intergenerational wealth and promote a fairer distribution of opportunities. This type of tax is a powerful tool for addressing wealth inequality and ensuring a level playing field for all Australians.

Ending inefficient tax concessions, such as negative gearing and capital gains tax discounts, would serve to reduce speculative behaviours that inflate housing prices and worsen wealth disparities.

These concessions disproportionately help property investors and high-income earners, contributing to social inequality. Removing such distortions ensures that the tax system supports housing affordability and reduces barriers for first-time homebuyers and low-income households.

Tax reforms also help to manage economic activity and address systemic challenges like climate change. For example, introducing carbon taxes or reforming subsidies that favour polluting industries can discourage environmentally harmful behaviours and incentivize sustainable practices. The revenue generated from these taxes, though not necessary for government spending, can serve as a tool for redistribution and targeted investments in green infrastructure and technologies.

By modernizing the tax system, the government can better address inequality, manage resource allocation, and promote behaviours that align with societal goals. These reforms would contribute to a more resilient and inclusive economy, where wealth and resources are distributed in ways that enhance public well-being rather than consolidating power and privilege among a select few.

The conversation around tax reform should shift from the misconception that taxes are needed to “fund” government spending to an understanding that taxes are a tool for economic management, equity, and the promotion of a fairer society. With this perspective, Australia can create a tax system that reflects the principles of social justice and economic sustainability.

Inflation and Economic Failures: The Consequence of Imbalanced Policies

Impact of Neoliberal Policies on General Populace

The neoliberal agenda, with its emphasis on deregulation and privatization, has contributed to a range of economic challenges for the average Australian. The cost of essential services like healthcare, education, and utilities has risen, placing added stress on household budgets. Furthermore, wage growth has not kept pace with productivity gains, leading to a decline in living standards for many workers.

The Role of Government Interventions

During economic downturns, government interventions often bail out corporations and banks considered ‘too big to fail,’ while ordinary citizens receive far less support. This approach not only worsens economic inequality but also reinforces a cycle of dependence on failing neoliberal policies. A shift towards policies that prioritize public welfare and robust economic support for all citizens is crucial for sustainable economic health.

Conclusion: Advocating for Economic Justice

The current state of Australia’s economy reflects a need for profound reform to address the imbalances created by decades of neoliberal policies. By realigning economic policies to focus on fairness, sustainability, and public welfare, Australia can pave the way for a fairer future.

Call to Action: Join the Movement for Economic Fairness

Are you ready to challenge the status quo and advocate for a fairer economic system in Australia? How will you engage in pushing for the necessary reforms?

Join the movement towards economic justice. Engage with advocacy groups, participate in policy discussions, and support political candidates who commit to economic reform. Your voice is critical in building a fairer and more equitable Australian economy.

References:

Economists warn worst is yet to come after interest rates rise: https://thenewdaily.com.au/finance/finance-news/2023/06/06/interest-rates-rba-june/

Jim Chalmers needs to step in and overrule out of control RBA: https://greens.org.au/news/media-release/jim-chalmers-needs-step-and-overrule-out-control-rba

Inflation isn’t happening by magic: https://youtu.be/XORo37Geeqw

Businesses are fuelling inflation with unnecessary price hikes: https://www.abc.net.au/news/2023-02-11/inflation-price-gauging-are-busiesses-fuelling-inflation/101958480