Description

Explore Philip Baker’s financial crimes and their lessons for solving Australias housing crisis using monetary sovereignty.

Introduction

The rise and fall of Philip Baker, a hedge fund manager whose fraudulent activities contributed to the global financial crisis (GFC), offers valuable insights into Australia’s ongoing housing crisis. By examining Baker’s story and the broader financial turmoil it symbolizes, we can show key lessons to address the housing affordability issues in Australia. This article explores these lessons and discusses how leveraging Australia’s monetary sovereignty could pave the way for solutions.

Australia’s Housing Crisis

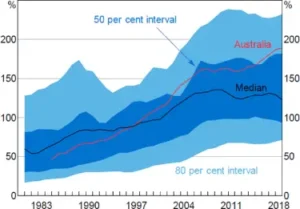

Escalating Property Prices

Australia has seen a dramatic increase in property prices over the past two decades. According to CoreLogic, the median house price in major cities like Sydney and Melbourne has more than doubled since 2000. This surge in property values has made homeownership increasingly unattainable for many Australians, especially younger generations.

High Household Debt

The Reserve Bank of Australia reports that household debt levels are now among the highest in the world, with many Australians borrowing heavily to afford homes. This debt burden creates economic vulnerability, making households sensitive to interest rate changes and economic shocks.

Rental Market Pressures

The rental market is also under significant strain. With vacancy rates at record lows, rents have been rising steadily, putting added pressure on low-income households. The Australian Bureau of Statistics highlights that rental costs have outpaced wage growth, worsening affordability issues.

Limited Social Housing

Australia’s social housing stock has not kept pace with demand. The Australian Housing and Urban Research Institute notes that the supply of public and community housing is insufficient to meet the needs of low-income Australians, leading to long waiting lists and housing insecurity.

Social and Economic Impacts

Homelessness

The housing crisis has led to a worrying increase in homelessness. Homelessness Australia reports that over 116,000 Australians are homeless on any given night. This lack of stable housing contributes to various social problems, including mental health issues, substance abuse, and family breakdowns.

Economic Inequality

The disparity in housing affordability contributes to broader economic inequality. High property prices and rents disproportionately affect low- and middle-income earners, widening the wealth gap. The Productivity Commission highlights that housing costs are a significant driver of economic inequality in Australia.

Political Disillusionment

The failure to address housing affordability has led to growing disillusionment with the political system. Many Australians feel that their government is not acting in their best interests, contributing to a sense of political instability and a lack of trust in democratic institutions.

Using Australia’s Monetary Sovereignty

Monetary Sovereignty Explained

As a sovereign currency issuer, Australia has the unique ability to create money to fund public services and investments. This monetary sovereignty means that the Australian government can afford to invest in housing, healthcare, education, and other critical areas without the constraints of budget deficits or debt.

Investing in Affordable Housing

A comprehensive housing policy should include significant public investment in affordable housing. This could involve:

– Building New Public Housing: Increasing the supply of public housing units to provide secure, affordable homes for low-income Australians.

– Subsidizing Rent: Providing rental subsidies to low-income households to make private rentals more affordable.

– Stabilizing the Rental Market: Implementing policies such as rent control and increased tenant protections to stabilize rental prices and improve housing security.

Strengthening Public Services

Investing in public services is crucial for creating a fairer society. This includes:

– Healthcare: Increasing funding for public hospitals and healthcare services to ensure all Australians have access to high-quality care.

– Education: Providing fair funding for public schools to improve educational outcomes and reduce disparities.

Implementing Progressive Economic Policies

To address economic inequality and support sustainable growth, the government should consider:

– Progressive Taxation: Implementing a more progressive tax system to redistribute wealth and fund public services.

– Increasing the Minimum Wage: Ensuring that all workers earn a living wage to reduce poverty and support economic stability.

– Expanding Social Safety Nets: Strengthening social welfare programs to support vulnerable Australians and reduce economic insecurity.

Summary

The rise and fall of Philip Baker and the later global financial crisis offer valuable lessons for addressing Australia’s housing crisis. By using Australia’s monetary sovereignty, investing in affordable housing, and strengthening public services, the government can create a more fair and stable society. These measures will not only improve housing affordability but also reduce economic inequality and restore trust in democratic institutions.

Engagement Question

What specific policies do you think the Australian government should implement to address the housing crisis and improve economic equality?

Call to Action

Learn more about advocating for change and transforming Australia’s political landscape at Social Justice Australia: https://www.socialjusticeaustralia.com. Share this article with your contacts and on social media to spread the word about the need for a more compassionate society.

References

Australian Bureau of Statistics. (2023). Residential Property Price Indexes: Eight Capital Cities.