Description: Australian Government Finances

Explore sectoral balances, fiscal policy, and Australia’s path to a compassionate political system using monetary sovereignty.

Introduction

Understanding the Australian government’s finances is crucial for grasping the broader economic picture. Misconceptions about budget surpluses and deficits often lead to misguided fiscal policies. This article delves into the intricacies of sectoral balances, the importance of balancing the economy over the budget, and how Australia can use its monetary sovereignty to create a more compassionate and ethical political system.

Misunderstanding Budget Surpluses

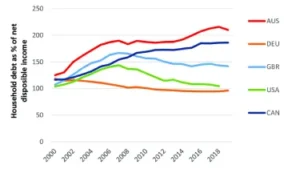

Many people believe that if the government has a budget surplus, it’s always good news. This idea comes from thinking about government money like household money—where saving more than you spend is good. But for a country, things work differently. For example, in 2018, Australia had a budget surplus of $5 billion. However, this meant the government took more money out of the economy than it put in, leading to more debt for everyone else.

Many people believe that if the government has a budget surplus, it’s always good news. This idea comes from thinking about government money like household money—where saving more than you spend is good. But for a country, things work differently. For example, in 2018, Australia had a budget surplus of $5 billion. However, this meant the government took more money out of the economy than it put in, leading to more debt for everyone else.

How the Economy is Divided

Government and Non-Government Sectors

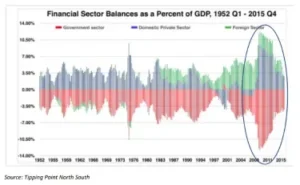

Our economy can be split into two parts: the government and everyone else (non-government). The government sector includes all the money the government spends and collects in taxes. The non-government sector includes households, businesses, and foreign trade.

The key takeaway is that the Australian government, as a currency issuer, is not fiscally constrained like a household. Thus, aiming for a balanced budget can be detrimental. For example, when the government runs a surplus, it means it is taxing more than it spends, which withdraws money from the economy, leading to a non-government sector deficit.

The Impact of Budget Surpluses on Real Life

When the government tries to save money by running a surplus, it often means cuts to public services and less money in people’s pockets. For example, the 2019 budget surplus led to cuts in essential services and made life harder for many Australians. This shows why it’s important to focus on the health of the economy, not just the government’s budget.

Why Private Enterprise Can’t Fill the Gap

Profit Motives of Private Enterprise

Relying on private enterprise to fill the gap in government spending is not an effective policy. Private businesses and corporations are primarily driven by profit motives. They will only invest if they can foresee a profit. This profit-oriented approach often overlooks essential public needs that are not profitable but crucial for societal well-being, such as healthcare, education, and infrastructure.

Limits of Private Investment

Private investment tends to focus on areas with high returns, leaving many critical sectors underfunded. For instance, private companies may not invest adequately in rural healthcare or public transportation because these areas do not promise significant profits. Consequently, relying on private enterprise can lead to inequities and gaps in essential services, which the government is better positioned to address through public spending.

How Our Economy Works

Four Ways Money Moves in the Economy

1. Consumer Spending: This is the money we all spend on goods and services.

2. Government Spending: This includes all the money the government spends on services, infrastructure, and more.

3. Business Investment: This is when businesses spend money to grow, expecting higher sales in the future.

4. Export Sales: This is the money we earn from selling goods and services to other countries, minus what we spend on imports.

These components all contribute to our economic activity. For instance, if the government spends less, consumers and businesses need to spend more to keep the economy going.

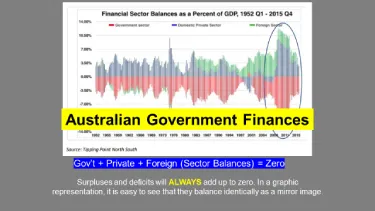

The Balancing Act

The equation Government + Private + Foreign = Zero means that the government’s budget balance directly affects everyone else. If the government has a surplus, then the private sector (households and businesses) ends up with less money. Conversely, a government deficit (spending more than it earns) means more money for the private sector.

How to Use Monetary Sovereignty for Good

The Role of Trade

The non-government sector includes not just domestic households and businesses but also foreign trade. Australia trades with other countries, and this trade affects our economy. For example, if we import more than we export, more money leaves the country than comes in. To balance this, the government can spend more or cut taxes.

Practical Policies for a Healthy Economy

1. Investing in Public Services: Funding for healthcare, education, and infrastructure is crucial for economic growth.

2. Fair Taxation: Implementing a fair tax system helps reduce inequality and boosts spending power for low-income families.

3. Encouraging Business Investment: Providing incentives for businesses to invest in growth and innovation.

These steps can help Australia use its ability to create money to build a stronger, fairer economy.

Summary

In conclusion, understanding how the government’s budget affects the economy is crucial. Budget surpluses aren’t always good and can sometimes harm economic growth. Additionally, relying on private enterprise to fill gaps in government spending is ineffective due to the profit motives of businesses. By focusing on the overall economy and using its power to create money, Australia can build a more balanced and fair society.

Question for Readers

What are your thoughts on how Australia can better use its ability to create money to help the economy? Share your ideas in the comments!

Call to Action

Get involved with the economic policies that shape our future. Learn more at Social Justice Australia: https://www.socialjusticeaustralia.com and become part of the solution for a balanced and thriving economy.

Social Sharing

If you found this article helpful, please share it with your friends and on social media to spread the word.